Business model

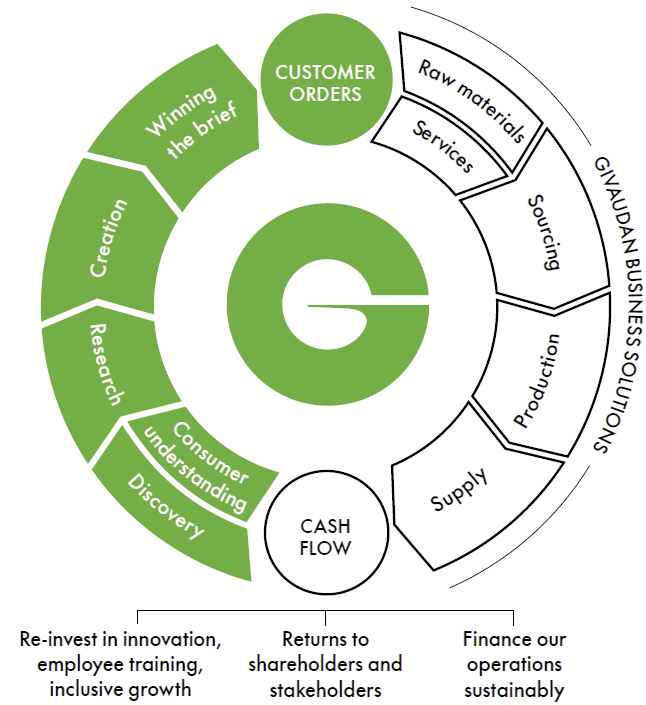

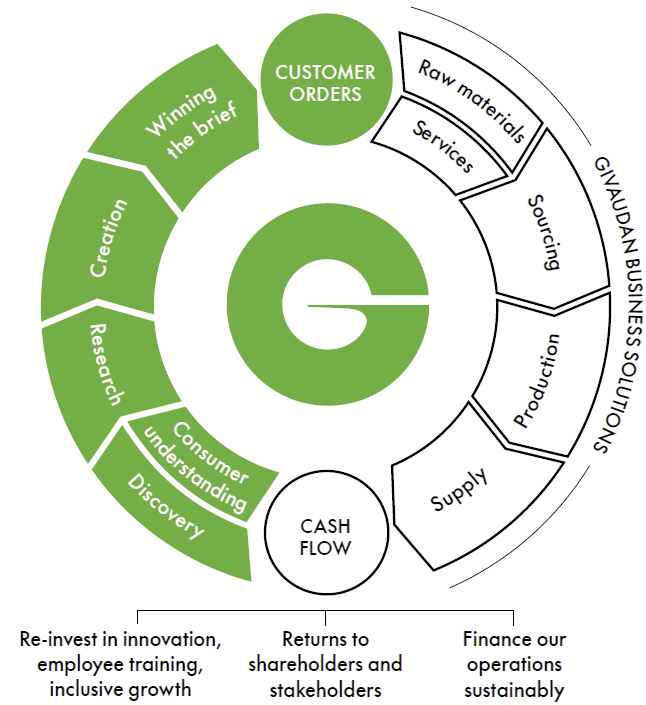

Through our value chain we draw on various resources (inputs) to create innovative products and solutions. The corresponding outputs and outcomes deliver growth that have a positive impact on nature, people and communities.

Our value creation process begins with resources called capital inputs.

Financial capital

- A– S&P, Baa1 Moody's Investment Grade Credit Rating

- CHF million 4,237 of equity

Intellectual capital

- >65 creation and research centres

- CHF million 522 R&D spend

Human capital

- > 16,670 employees

- 1,806 managers took part in the leadership programmes since 2015

Natural capital

- > 12,400 different raw materials sourced

- 26% of raw materials sourced locally

Operations capital

- 78 production sites supporting our customers' growth globally

- 3-4% of sales invested annually in Capex

Social and relationship capital

- 17,300 suppliers

- 68 community projects in 28 countries

Our value creation

How we operate

|

Our value chain

|

Our business model uses these capital inputs for the realisation of our business activities. Taste & Wellbeing, and Fragrance & Beauty, aim to shape the future of food, fragrances and beauty by becoming the innovation and co-creation partner of choice to our customers.

Financial capital

- CHF million 7,117 sales

- 20.9% comparable EBITDA

Intellectual capital

- 4,000 active patents worldwide

- > 20% of sales resulting from innovations developed over the last five years

Human capital

- 27% of senior leaders from high growth markets

- –36% reduction of recordable case rate

Natural capital

- –35% GHG reduction scope 1+2

- –13% water withdrawal rate for sites located in areas facing water-stress

Operations capital

- 126,460 products sold

- Opening of our Consumer & Sensory Insights centre and the integrated fragrance encapsulation centre

Social and relationship capital

- 100% of our production sites are registered on Sedex

- 100% of our Taste & Wellbeing production sites are GFSI-certified standards

Environmental

+ Impacts

– Impacts

Mitigation measures

Social

+ Impacts

– Impacts

Mitigation measures

Economic

+ Impacts

– Potential impacts

Mitigation measures

Long-term growth for our stakeholders, our business, for society and the planet

Effective and transparent governance

Our contributions to the

United Nations Sustainable Development Goals