Compensation

Our compensation policies are an essential component of our employee value proposition and a key driver of both individual and business performance

The ability to attract, motivate and retain the right talented employees globally is key to the continued success of Givaudan. Our competitive remuneration policy supports this ambition and is based on the following principles:

- Pay for performance.

- Alignment of interests.

- External competitiveness.

- Internal consistency and fairness.

Total compensation in 2022 is composed of the following elements:

- Base salary for all employees.

- Benefits for all employees (including retirement, insurance and health care plans).

- Cash-based Profit Sharing Plan for approximately 12,000 non-management employees based on Group financial objectives.

- Cash-based Annual Incentive Plan for around 5,000 managers and executives.

- Equity-based Performance Share Plan (PSP) for the top 500 employees.

Base salaries are regularly benchmarked in each location and pay scales are reviewed annually according to local market evolution. As a general rule, pay scales are built around market median. Benefit plans seek to address current and future security needs of employees. These generally include retirement, health, death and disability benefits.

Non-management employees participate in the global Profit Sharing Plan. Payouts are based on the yearly evolution of Group EBITDA.

The Annual Incentive Plan covers all managers and executives globally. It rewards participants for the achievement of financial targets and other organisational and individual objectives.

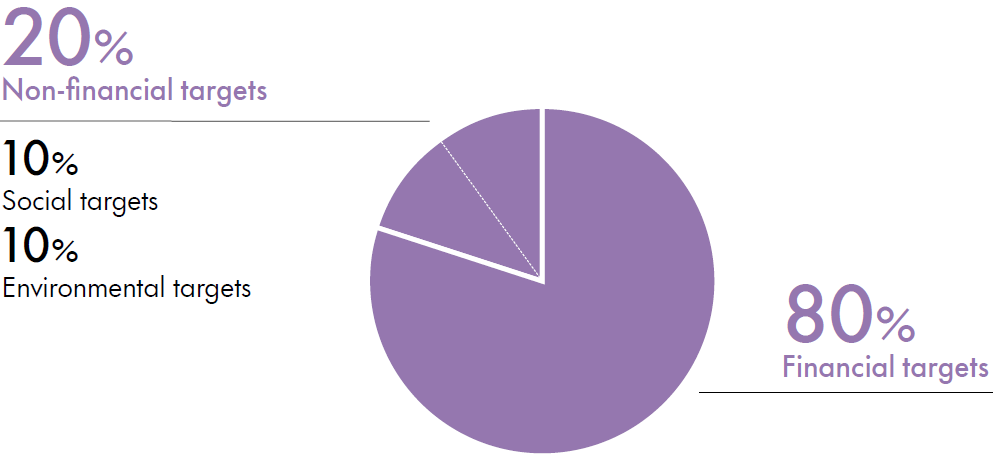

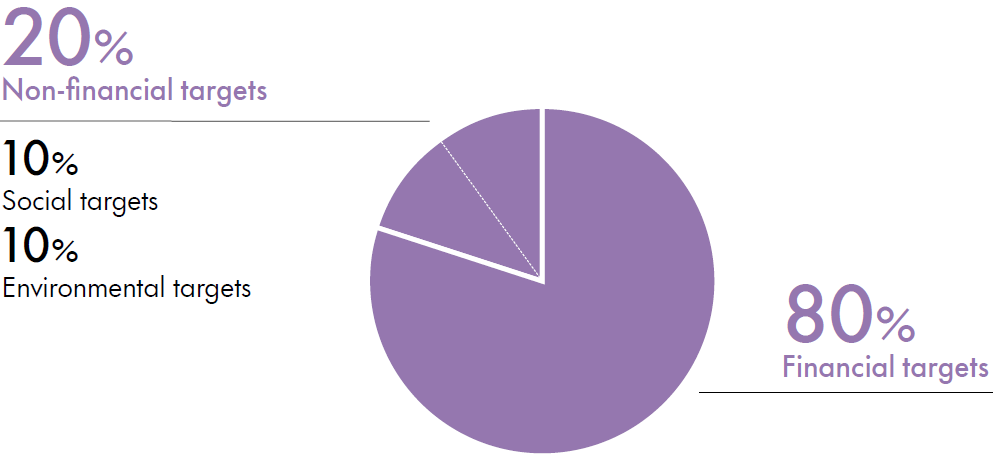

The PSP is designed to reward executives and key talent who significantly influence the long-term success of the business and our purpose ambitions. From 1 January 2021, a new PSP aligned with the Givaudan purpose was introduced. The financial metrics of sales and free cash flow traditionally used to calculate the PSP are retained, and are complemented by non-financial criteria linked to three of the four focus areas of the Givaudan purpose:

- Creations: Financial targets of sales and free cash flow

- Nature: Environmental targets of net GHG emissions reduction

- People: Social targets of senior leader diversity and employee safety

Performance Share Plan for top 500 employees

Compensation of the Board of Directors

Compensation of Board members consists of Director fees, Committee fees and Restricted Share Units (RSUs). Fees are paid at the end of each year in office completed. RSUs give participants the right to receive Givaudan shares (or a cash equivalent in countries where securities laws prevent the offering of Givaudan securities) at the end of a three-year blocking period. During this period, Board members must hold RSUs (accordingly are restricted from trading RSUs or the underlying Givaudan shares), thereby aligning with shareholder interests over the longer term. Board members are entitled to receive Givaudan shares regardless of membership status so that, for example, if re-election does not occur during the restriction period, awarded RSUs are retained by the respective Board member. Such practice has been implemented in line with best practice in support of Givaudan’s commitment to ensuring Board independence.

The compensation of CHF 3,115,544, paid to the Board members for the period between the 2021 and 2022 Annual General Meetings is again within the amount approved by shareholders at the 2021 Annual General Meeting. The amount approved at the 2022 Annual General Meeting (CHF 3,500,000), will be paid by the end of the year in office and validated in the 2023 Compensation report. Such approved and paid amounts may differ from those shown in the Board compensation summary table which, according to the OaEC, must include compensation paid in the reporting year.

Board of Directors compensation summary

| in Swiss francs | Year |

Director fees 3 |

Committee fees 3 |

Total fixed (cash) |

Number |

Value at grant4 |

Total compensation |

| Calvin Grieder, Chairman 1 | 2022 | 400,000 | 65,000 | 465,000 | 160 | 578,816 | 1,043,816 |

| 2021 | 400,000 | 65,000 | 465,000 | 169 | 580,566 | 1,045,566 | |

| Victor Balli 1 | 2022 | 100,000 | 80,000 | 180,000 | 40 | 144,704 | 324,704 |

| 2021 | 100,000 | 72,500 | 172,500 | 42 | 144,283 | 316,783 | |

| Prof.Dr-Ing. Werner Bauer 1 | 2022 | 100,000 | 65,000 | 165,000 | 40 | 144,704 | 309,704 |

| 2021 | 100,000 | 65,000 | 165,000 | 42 | 144,283 | 309,283 | |

| Lilian Biner 1 | 2022 | 100,000 | 25,000 | 125,000 | 40 | 144,704 | 269,704 |

| 2021 | 100,000 | 25,000 | 125,000 | 42 | 144,283 | 269,283 | |

| Michael Carlos 1 | 2022 | 100,000 | 65,000 | 165,000 | 40 | 144,704 | 309,704 |

| 2021 | 100,000 | 65,000 | 165,000 | 42 | 144,283 | 309,283 | |

| Ingrid Deltenre 1 | 2022 | 100,000 | 50,000 | 150,000 | 40 | 144,704 | 294,704 |

| 2021 | 100,000 | 50,000 | 150,000 | 42 | 144,283 | 294,283 | |

| Olivier Filiol 1 | 2022 | 100,000 | 50,000 | 150,000 | 40 | 144,704 | 294,704 |

| 2021 | 100,000 | 50,000 | 150,000 | 42 | 144,283 | 294,283 | |

| Sophie Gasperment 1 | 2022 | 100,000 | 43,750 | 143,750 | 40 | 144,704 | 288,454 |

| 2021 | 100,000 | 25,000 | 125,000 | 42 | 144,293 | 269,283 | |

| Tom Knutzen 1 | 2022 | 75,000 | 18,750 | 93,750 | 40 | 108,528 | 202,278 |

| 2021 | |||||||

| Thomas Rufer 7 | 2022 | ||||||

| 2021 | 25,000 | 13,750 | 38,750 | 13 | 36,329 | 75,079 | |

| Total compensation 2 | 2022 | 3,337,772 | |||||

| Total compensation 2 | 2021 | 3,183,126 |

-

The function of each member of the Board of Directors is indicated on pages 7–9 in the 2021 Governance report and 13–15 in the 2022 Governance Report.

-

Represents total compensation of the Board of Director paid in respect of the reporting year, reported in accordance with the accrual principle.

-

Represents Director and Committee fees paid in respect of the reporting year, reported in accordance with the accrual principle.

-

2022 RSUs blocking period end on 15 April 2025; 2021 RSUs end on 15 April 2024.

-

Economic value at grant according to IFRS methodology with no discount applied for the blocking period.

-

2022 figures represent compensation from April to December.

-

Thomas Rufer retired at the AGM in March 2021.

Estimated social security charges based on 2022 compensation amounted to CHF 258,719 (2021: CHF 263,416).

Compensation of the Executive Committee

Total Executive Committee (EC) compensation reported in 2022 remained stable compared to 2021, representing full-year compensation for seven members (including the Chief Executive Officer). decreased by 6.6%, reflecting lower annual incentive achievement. Total fixed compensation and long-term incentive grant values remain stable.

The compensation paid is within the amounts approved by shareholders at the respective Annual General Meeting. The fixed and long term variable compensation approved for 2022 was CHF 15,400,000 (2021: CHF 15,400,000). The annual incentive, short-term variable compensation amount for 2022 was CHF 3,336,733 and will be submitted for approval at the 2023 Annual General Meeting (2021: CHF 5,461,355).

Executive Committee (EC) compensation summary

| in Swiss francs | Year |

Base salary |

Pension benefits 2 |

Other benefits 3 |

Total fixed compensation |

Annual incentive 4 |

Number of performance shares granted 5 |

Value at grant 6 |

Total variable compensation |

Total compensation |

Employer social security 7 |

| Gilles Andrier, CEO | 2022 | 1,228,041 | 573,379 | 134,689 | 1,936,109 | 1,114,879 | 691 | 2,499,762 | 3,614,641 | 5,550,750 | 459,497 |

| 2021 | 1,221,418 | 578,371 | 141,079 | 1,940,868 | 1,862,933 | 728 | 2,500,898 | 4,363,831 | 6,304,699 | 525,879 | |

| EC, excluding CEO 1 | 2022 | 3,283,409 | 1,096,069 | 400,918 | 4,780,396 | 2,221,854 | 1,631 | 5,900,306 | 8,112,160 | 12,902,556 | 993,217 |

| 2021 | 3,228,752 | 1,086,554 | 388,786 | 4,704,092 | 3,598,422 | 1,688 | 5,798,786 | 9,397,208 | 14,101,300 | 1,073,231 | |

| Total: EC, including CEO | 2022 | 4,511,450 | 1,669,448 | 535,607 | 6,716,505 | 3,336,733 | 2,322 | 8,400,068 | 11,736,801 | 18,453,306 | 1,452,714 |

| 2021 | 4,450,170 | 1,664,925 | 529,865 | 6,644,960 | 5,461,355 | 2,416 | 8,299,684 | 13,761,039 | 20,405,999 | 1,599,110 |

-

Represents full year compensation of six Executive Committee members.

-

Company contributions to broad-based pension and retirement savings plans and annualised expenses accrued for supplementary executive retirement benefit.

-

Represents annual value of health and welfare plans, international assignment benefits and other benefits in kind.

-

Annual incentive accrued in reporting period based on performance in the reporting period.

-

2022 Performance shares vest on 15 April 2025, 2021 Performance Shares vest on 15 April 2024.

-

Value at grant calculated according to IFRS methodology and based on 100% achievement of performance targets.

-

2022 estimated social security charges based on 2022 compensation; 2021 estimated social security charges based on 2021 compensation.

Ownership of Givaudan securities

As per 31 December 2022, the Chairman and other Board members, including persons closely connected to them held 6,850 Givaudan shares in total. The Chief Executive Officer and other members of the Executive Committee, including persons closely connected to them, held 9,637 Givaudan shares. One person closely connected to a member of the Executive Committee owned 159 unvested Performance Shares as at 31 December 2022.

Board of Directors: ownership of Givaudan securities

| 2022 in numbers |

Shares | Blocked RSUs |

| Calvin Grieder, Chairman | 1,199 | 537 |

| Victor Balli | 311 | 134 |

| Prof. Dr-Ing. Werner Bauer | 1,491 | 134 |

| Lilian Biner | 798 | 134 |

| Michael Carlos | 1,323 | 134 |

| Ingrid Deltenre | 428 | 134 |

| Olivier Filliol | 1,200 | 134 |

| Sophie Gasperment | - | 112 |

| Tom Knutzen | 100 | 40 |

| Total 2022 | 6,850 | 1,493 |

| Total 2021 | 6,183 | 1,580 |

Executive Committee: ownership of Givaudan securities

| 2022 in numbers |

Shares | Unvested Performance Shares |

| Gilles Andrier, CEO | 4,714 | 2,314 |

| Tom Hallam | 335 | 1,000 |

| Louie D'Amico | 819 | 1,157 |

| Maurizio Volpi | 1,463 | 1,157 |

| Simon Halle-Smith | 524 | 694 |

| Willem Mutsaerts | 832 | 694 |

| Anne Tayac | 791 | 694 |

| Total 2022 | 9,478 | 7,710 |

| Total 2021 | 7,869 | 8,928 |

Click here to read more about compensation.